If you wish to transfer to a different home and take your existing Halifax mortgage and mortgage rate with you to the new house, this may be achievable If the Halifax mortgage is transportable.

Just as NerdWallet recommends browsing about when evaluating mortgage lenders, you ought to do the exact same when choosing a mortgage broker. Right after doing your investigation, narrow down your listing to at least 3 candidates. Then, ask them these issues:

It might be overwhelming after you don’t know where to begin, what info is necessary, and the way to get a bank loan. A mortgage broker acts as an middleman amongst the applicant plus the money institution.

Money Management tipsSaving moneyHandling charges and expensesShoppingShopping rewardsFinancial healthSavings objective calculatorNet value calculator

Our mortgage reporters and editors deal with the details people treatment about most — the newest costs, the top lenders, navigating the homebuying approach, refinancing your mortgage and much more — so that you can feel self-confident any time you make conclusions to be a homebuyer in addition to a homeowner.

Register and we’ll deliver you Nerdy posts with regards to the cash matters that make a difference most to you in conjunction with other means that can assist you get additional from your hard earned money.

If you have a good credit score score, you’re prone to stand a better probability of obtaining a Halifax mortgage than In the event your credit rating is reduced, however, you’ll also have to have to meet its other eligibility criteria, which generally involves items like deposit sizing, revenue and expenditure.

Generally, FHA loans require a minimal score of 580 and Fannie Mae includes a credit history rating need of 620 for standard mortgages, but this necessity can be lessen For added borrowers on the financial loan.

A mortgage loan broker assists a myriad of borrowers get the most effective offer. This motivation might be Primarily useful for borrowers with exclusive instances, for instance lousy credit score or possibly a wish to invest in a specific type of home.

Own Up tends to make no representations or warranties of any kind, express or implied, regarding the completeness, accuracy, dependability, suitability or availability with regard on the weblog or the information, solutions, solutions, or associated graphics contained within the website for almost any function. Any reliance you place on these kinds of data is more info as a result strictly at your individual chance.

We use primary resources to support our do the job. Bankrate’s authors, reporters and editors are matter-subject authorities who completely point-Check out editorial content material to be certain the information you’re reading through is accurate, timely and relevant.

Even if you don’t pay out an advisor upfront, borrowers can pay to operate which has a mortgage advisor one way or An additional, because the lender could shell out the mortgage advisor a commission, that's inevitably crafted into the expense of your personal loan.

Choosing the proper lender can make sure you will get the ideal available deal on your mortgage. A educated and expert broker who understands your preferences can present a range of options for you to check, generating the mortgage software system much smoother — and probably conserving you thousands of dollars above the life of the bank loan.

When trying to find a mortgage advisor, request questions to ensure the advisor can meet your requirements. You may also look at their Web-site and online reviews to get an even better idea of how they’ve labored with men and women up to now.

Spencer Elden Then & Now!

Spencer Elden Then & Now! Daniel Stern Then & Now!

Daniel Stern Then & Now! Devin Ratray Then & Now!

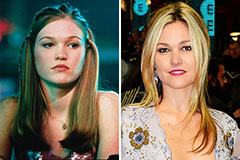

Devin Ratray Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! The Olsen Twins Then & Now!

The Olsen Twins Then & Now!